Summary:

The global yellow peas market is experiencing a significant shift as competition between Canada and Russia intensifies, driving prices below $500 per tonne. This analysis explores how Russia's emergence as a major exporter is reshaping traditional trade routes and what it means for key importing nations like China, India, and Bangladesh.

Current Market Dynamics

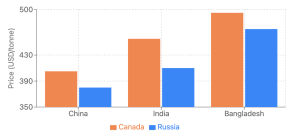

Price Trends

- Canadian yellow peas offered to Bangladesh at $495/tonne (December-January delivery)

- Price reduction of $5/tonne from previous week

- Canadian offers to China at $405/tonne (December-January delivery)

- Canadian offers to India at $455/tonne (December-January delivery)

Russian Competition

- Russian offers to key markets (November-December delivery):

- China: $380/tonne

- India: $410/tonne

- Pakistan: $405/tonne

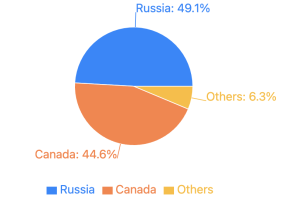

Market Share Shifts

China Market

- Russia has overtaken Canada as the top yellow peas exporter

- Canada's market share dropped to 44.6% (previously 95-97%)

- Russia's market share increased to 49.1%

Indian Market

- Significant increase in Russian pulse imports

- 23-fold increase in supplies (January-September 2024)

- Total volume reached 545,000 tonnes

Russian Export Evolution

Historical Context

- 2017-2022: Exports ranged between 1.1-1.7 million tonnes annually

- 2023-24: Exports surged to over 3 million tonnes

- 2024-25: Projected decline to 2.5 million tonnes (some estimates as low as 1.7 million tonnes)

Production Factors

- 2023-24 highlights:

- Record production of 4.7 million tonnes

- Carryover stocks of 550,000 tonnes

- 2024-25 forecast:

- Initial projection: 5 million tonnes

- Challenges: Productivity affected in southern Russia due to adverse weather conditions

Conclusion

The yellow peas market is undergoing a fundamental transformation as Russia emerges as a major competitor to traditional exporters. This shift has significant implications for global trade patterns and pricing strategies. While Russia's export volumes are expected to decrease in 2024-25, its influence on market dynamics remains substantial. Traders and importers should closely monitor weather conditions in southern Russia and potential production impacts, as these factors could further affect global supply and pricing trends.