The sugar market has taken a bullish turn, with raw sugar futures on the Intercontinental Exchange (ICE) reaching a seven-month peak. October raw sugar futures closed at 23.55 US cents per pound on Wednesday, marking a significant uptick in prices.

Brazilian Challenges

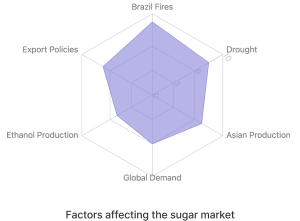

The primary driver behind this surge is the growing concern over potential global supply shortages. Brazil, a key player in the sugar market, faces two major challenges:

- Devastating Fires: Sao Paulo, Brazil's crucial sugar-producing region, has been hit by severe fires. These blazes have put the availability of approximately 5 million tonnes of sugarcane in jeopardy.

- Historic Drought: The Latin American nation is experiencing an unprecedented dry spell, further complicating sugar production.

These factors have prompted speculators and money managers to shift their strategies, moving from short to long positions in the market.

Adding to the bullish sentiment, Brazilian ethanol producers are expressing concerns about the 2025-26 sugarcane harvest due to the ongoing drought conditions.

Asian Market: A Glimmer of Hope

While the situation in Brazil paints a grim picture, the Asian market offers some optimism for the sugar industry:

1. Thailand

- Production is expected to recover in the 2024-25 season.

- Consumption growth is anticipated to slow down, partly due to sugar taxes on non-alcoholic beverages.

- September rains, influenced by Typhoon Yagi, could potentially boost sugarcane yields.

2. India

India presents a promising outlook, though much depends on government decisions regarding export resumption. Key points include:

- Record-high sugarcane acreage at 57.8 lakh hectares this year.

- Potential policy allowing sugar mills to choose between using excess cane for sugar exports or ethanol production.

Market Outlook

Despite the overall bullish trend, London white sugar prices remain below $600 per tonne. Industry observers recommend a wait-and-watch approach as the situation unfolds over the next couple of months.

In conclusion, while Brazil's challenges have pushed the market into bullish territory, Asia's potential recovery could help balance global sugar supply and demand in the coming seasons.