Summary:

In the ever-evolving landscape of global agriculture, recent data from the U.S. Department of Agriculture (USDA) has caught the attention of commodity traders and market analysts alike. The latest World Agricultural Supply and Demand Estimates (WASDE) report paints an intriguing picture for wheat and corn markets, suggesting potential bullish trends on the horizon.

Wheat Market Overview

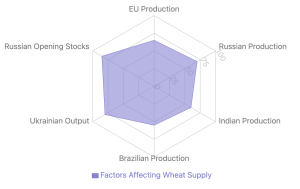

The USDA's projections for the 2024-25 wheat season indicate a significant shift in the supply-demand dynamics:

- Global Supplies: Expected to decrease to 1,060.3 million tonnes, primarily due to reduced production in key regions such as the European Union, Russia, India, and Brazil.

- Ending Stocks: While slightly higher than initial estimates, the projected 257.7 million tonnes would mark the lowest level since 2015-16.

- Consumption: Global flour consumption is anticipated to drop by 2.4 million tonnes to 802.5 million tonnes, with notable decreases in India and Afghanistan.

- Trade: World flour trade is forecasted at 215.8 million tonnes, a slight decrease from earlier projections.

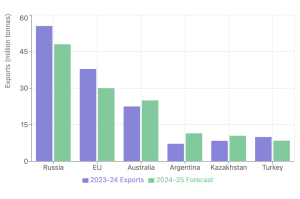

Key Export Shifts:

- Russia: Expected to export 48 million tonnes, down 7.5 million tonnes from the previous season.

- European Union: Projections lowered to 30 million tonnes from 31.5 million tonnes.

- Australia: Anticipated increase to 25 million tonnes from 22.50 million tonnes.

- Argentina and Kazakhstan: Both expected to see increases in exports.

These shifts in the global wheat landscape have already begun to impact markets, with Chicago wheat prices rising $1.10 per bushel since August lows, and Russian cash wheat prices increasing by $20 per tonne.

Corn Market Outlook

The corn market outlook presents a complex scenario:

- Global Production: Forecasted at 1,217.2 million tonnes for 2024-25, down from 1,225.9 million tonnes in 2023-24.

- Consumption: Expected to rise slightly to 1,216.7 million tonnes.

- Ending Stocks: Projected to decrease to 306.5 million tonnes from 312.7 million tonnes.

- Global Trade: Anticipated to drop to 184.1 million tonnes from 195 million tonnes in the previous season.

Notable production decreases are expected in Ukraine, Egypt, Russia, and the Philippines, partially offset by an increase in India.

Market Implications and Factors to Watch

- Russian Export Policies: Speculation around potential increases in export taxes and curbs on exports from Russia could significantly impact global wheat supply.

- Weather Conditions: Current dry weather in Russia and concerns over soil moisture for planting in key regions are crucial factors to monitor.

- Chinese Demand Shift: While China's corn import volume is expected to remain stable at 23 million tonnes, there's a projected shift in sourcing from Brazil to the United States.

- Turkish Import Policies: Turkey's decision to end its import ban on October 15, with stipulations on sourcing, could influence regional trade dynamics.

- Indian Production: The upcoming rabi crop sowing in India could potentially moderate global wheat prices if production increases.

For commodity traders and agricultural stakeholders, these developments underscore the importance of staying informed and agile in response to rapidly changing market conditions.

Conclusion

The USDA WASDE report paints a bullish picture for both wheat and corn markets in the 2024-25 season. Lower global supplies, reduced ending stocks, and changing trade patterns are likely to put upward pressure on prices. However, potential dampeners like China's higher-quality wheat crop and possible increases in Indian production could moderate price rises. Traders and investors should closely monitor these developments, particularly the dry weather conditions in Russia and the evolving export policies of major producing countries. The shift in China's corn import sources from Brazil to the U.S. could also have significant implications for global corn trade dynamics.