Summary

The upcoming US presidential election could significantly impact global grain trade dynamics, with both leading candidates signaling protectionist policies. This analysis explores how potential trade policies under Harris or Trump could reshape international agricultural markets, affect key trading relationships, and influence global food supply chains.

Key Takeaways

- Both presidential candidates are indicating protectionist trade policies

- Trump proposes 60% tariffs on Chinese imports, 10% on other countries

- Harris signals more targeted approach but maintains protectionist stance

- Previous US-China trade tensions resulted in $27 billion agriculture sector losses

- Potential market shifts could create new opportunities for alternative suppliers

Detailed Analysis

Growing Concerns in Global Grain Markets

The global grain trade community is watching the US presidential election with increasing concern. Recent policy positions from candidates Kamala Harris and Donald Trump suggest a continued shift toward protectionist trade policies, potentially disrupting established trading patterns.

Potential Policy Impacts

According to GrainGrowers' report "Navigating Uncertainty: What the United States Election Means for Australia's Grain Industry," both candidates' approaches could:

- Intensify US-China tensions

- Accelerate friend-shoring trends

- Further fragment the rules-based global trading order

Trump's Trade Vision

Trump's "America First" platform includes:

- 60% tariff on Chinese imports

- 10% tariff on all other countries

- Critical stance on multilateral systems like NATO and WTO

Harris's Approach

While more moderate, Harris's position includes:

- Support for targeted strategic tariffs

- Opposition to US-Mexico-Canada Agreement

- Concerns about Trans-Pacific Partnership

Market Impact Analysis

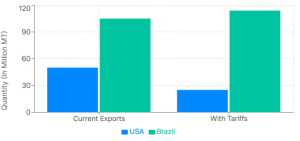

Recent trade studies predict significant market shifts:

- US soybean exports to China could decrease by 15 million tonnes

- Corn exports might drop by over 2 million tonnes

- Brazil could gain 8.9 million tonnes in annual soybean and corn exports

Historical Context

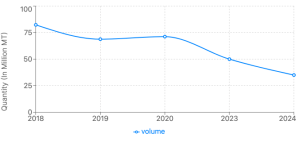

The 2018-19 trade tensions resulted in:

- $27 billion loss in US agriculture sector

- 13.5 million tonnes drop in US exports

- $28 billion government aid package required

Current Market Dynamics

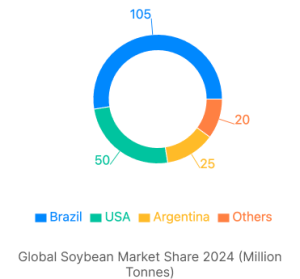

USDA forecasts for current marketing year:

- US soybean exports: 50 million tonnes

- Brazil soybean exports: 105 million tonnes

WTO Perspective

WTO Director-General Ngozi Okonjo-Iweala warns that proposed tariffs could:

- Spark a "free-for-all" in international trade

- Destabilize global trading systems

- Trigger retaliatory measures worldwide

Conclusion

The upcoming US presidential election represents a critical juncture for global grain trade. Regardless of the outcome, the trend toward protectionist policies seems likely to continue, requiring agricultural traders and stakeholders to adapt their strategies. Market participants should:

- Diversify their trading partnerships

- Strengthen regional trade relationships

- Monitor policy developments closely

- Prepare contingency plans for various scenarios

- Consider emerging markets as alternative trade routes

As we approach January 2025, the global grain trade landscape may undergo significant transformation, creating both challenges and opportunities for market participants. Success will depend on agility, foresight, and the ability to navigate an increasingly complex trading environment.