Summary:

Recent drops in urad (black matpe) prices may not indicate a long-term trend. Despite current declines, factors such as crop damage in India, reduced acreage, and limited Myanmar supply suggest potential price increases from December. Weather conditions and actual crop assessments will be crucial in determining future market trends. Stakeholders should look beyond current prices for accurate long-term projections.

Current Market Situation

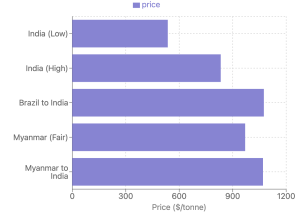

1. Prices:

- Global: Dropped by $5-10 per tonne this week

- India: ₹45,000-70,000 ($536-833) per tonne

- Brazil to India: $1,075/tonne for October-November delivery (down $5)

- Myanmar: $970/tonne for fair average quality, $1,070 for October-November delivery to India

2. Indian Kharif Crop:

- Prices lower than the minimum support price of ₹74,000/tonne due to poor quality

- Farmers selling entire crop due to rain damage in Maharashtra, Gujarat, Uttar Pradesh, and Karnataka

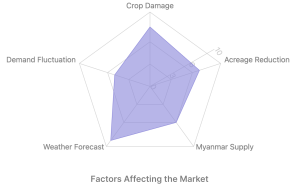

Factors Affecting the Market

1. Supply Concerns:

- Estimated 30% crop damage from September rains

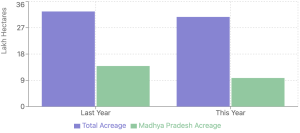

- Kharif acreage down to 30.73 lakh hectares from 32.60 lakh hectares last year

- Madhya Pradesh acreage decreased to 9.79 lakh hectares from 13.90 lakh hectares

2. Myanmar Supply:

- Small crop usually arriving in December not available this year

- New crop expected in February

- Current stocks only 200,000 tonnes

3. Demand:

- Currently slack after Diwali (Deepavali)

4. Weather Outlook:

- India Meteorological Department forecasts above-normal rainfall for October-December

- Potential impact on rabi black matpe crop

Future Outlook

1. Short-term:

- Current price drop may be misleading

- Potential for price increase from December due to tight market balance

2. Medium-term:

Prices beyond December dependent on:

- Rabi crop performance

- Weather conditions in India and Myanmar

- Soil moisture and reservoir levels (currently favourable)

3. Factors to Watch:

- Weather developments in the Bay of Bengal (potential impact on Myanmar)

- Actual crop damage assessment in India

- Myanmar's export volumes

Conclusion

While current urad prices show a downward trend, various factors suggest potential price firmness in the coming weeks. The market faces supply challenges due to crop damage and reduced acreage in India, coupled with limited availability from Myanmar. Weather conditions will play a crucial role in determining future price trends, particularly for the rabi crop. Traders and consumers should closely monitor these factors for a more accurate market outlook beyond December.