Sugar prices can tell us a lot about what's happening in the world economy. They're affected by many factors, including energy prices, decisions made by central banks, and how much sugar is being produced.

Right now, the U.S. Federal Reserve might lower interest rates soon. This could have a big impact on sugar prices, showing how closely connected different parts of the global economy are.

Sugar isn't just for sweetening your coffee. Its price can actually hint at bigger economic trends. For example, it can show us how well developing countries are doing economically, or how the push for renewable energy is going worldwide.

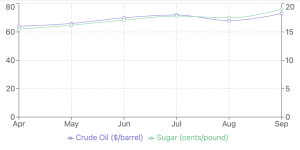

This report looks at what's currently happening in the sugar market. We'll explore how upcoming decisions about interest rates and changes in oil prices might affect sugar prices. By understanding these connections, investors and economists can get a better picture of what's happening in the global economy.

Monetary Policy: The Fed's Potential Impact

The anticipated 50 basis point interest rate cut by the U.S. Federal Reserve introduces another layer of complexity to the sugar market outlook. Here's how it could influence prices:

- Economic Stimulation: Lower interest rates typically boost economic activity.

- Increased Commodity Demand: A more robust economy often leads to higher demand for commodities, including sugar.

- Currency Effects: Interest rate cuts can lead to a weaker dollar, potentially making dollar-denominated commodities like sugar more attractive to foreign buyers.

- Investment Flows: Lower yields in fixed-income markets may drive more investment into commodities as alternative assets.

This potential rate cut, when viewed in conjunction with the energy market dynamics, creates a complex but potentially bullish scenario for sugar prices.

Strategic Considerations for Market Participants

Given these multi-faceted market influences, traders and investors should consider the following strategies:

- Holistic Market Analysis: Integrate analysis of crude oil prices, monetary policy expectations, and sugar production data for a comprehensive market view.

- Scenario Planning: Develop trading strategies that account for various outcomes of the Fed's decision and potential crude oil price movements.

- Supply-Side Monitoring: Keep a close eye on production reports from key sugar-producing regions, particularly Brazil's Center-South.

- Macro-Economic Indicators: Monitor global economic health indicators as they may influence both policy decisions and commodity demand.

- Currency Market Vigilance: Watch for any significant USD movements post-Fed decision, as they could impact sugar's dollar-denominated pricing.

In Conclusion

Trading sugar in the current market environment requires a nuanced understanding of global economic forces. The sugar market serves as a microcosm of broader economic trends, reflecting the impacts of energy policies, monetary decisions, and agricultural production dynamics.

For the discerning trader, these complex interrelationships offer not just challenges, but opportunities. By synthesizing insights from various economic sectors and understanding their cascading effects, one can potentially anticipate market movements with greater accuracy.