Market Shift

The global yellow peas market is seeing a significant change as Russia becomes a strong alternative to Canada, the traditional market leader. Two key developments highlight this shift:

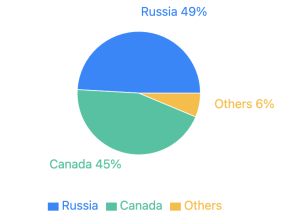

- Russia overtook Canada as China's top yellow peas exporter in 2023-24. Russia's market share in China rose to 49.1%, while Canada's dropped to 44.6% from its previous 95-97% dominance.

-

Russia gained approval to regularly supply lentils to India. Russian legume exports to India increased 23-fold year-on-year, reaching 545,000 tonnes by September 22, 2024.

Russian Export Performance

Russia's rise in the pea market has been remarkable:

- In 2023-24, Russia exported over 3 million tonnes of peas, triple the amount from 2022-23.

- This surge was supported by record production of 4.7 million tonnes and carryover stocks of 550,000 tonnes.

- For 2024-25, initial forecasts predicted a 5 million tonne crop, but dry and cold conditions in southern Russia have led to lower estimates.

Current projections for 2024-25 suggest Russian pea exports may drop to 2.5 million tonnes, with some pessimistic views suggesting as low as 1.7 million tonnes.

Price Competitiveness

Russia currently holds a price advantage:

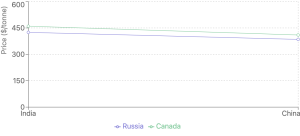

For delivery to India (October-November):

- Russia: $425/tonne

- Canada: $460/tonne

For delivery to China (October-November):

- Russia: $385/tonne

- Canada: $410/tonne

Canada's Position

Despite losing market share, Canada remains a strong player:

- 2024-25 dry pea production forecast: 3.3 million tonnes

- Total supplies expected: 3.6 million tonnes

- Projected exports: 2.5 million tonnes

India: A New Battleground

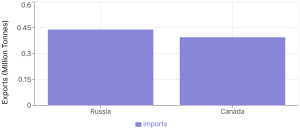

In the April-July period of 2024-25, Russia surpassed Canada in pulse exports to India:

- Russia: 0.44 million tonnes

- Canada: 0.395 million tonnes

One of the reasons for this could be Russia offering the facility of trading in rupees, making transactions more convenient and potentially more cost-effective.

Future Outlook

While Russia currently has a competitive edge, several factors will influence the market going forward:

- Weather conditions in Russia's growing regions

- Production volumes in both Russia and Canada

- Global demand, particularly from major importers like China and India

The yellow peas market is likely to remain dynamic, with both Russia and Canada vying for market share in key importing countries.