Summary

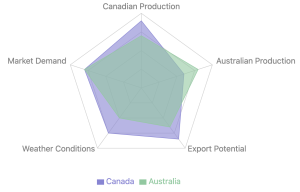

The global pulse market is experiencing significant shifts, with Canada reporting a larger crop than last year despite recent dry weather, while Australia faces mixed fortunes across its pulse-growing regions. This update explores the production forecasts, regional variations, and key factors that will influence the pulse market in the coming months, providing crucial insights for traders and investors in the agricultural commodities sector.

Let's dive into the latest insights on the pulse market dynamics, focusing on Canada and Australia – two key players in the global pulse trade.

Canadian Pulse Outlook

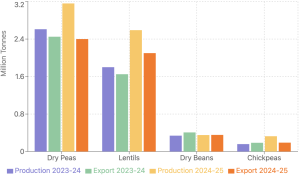

Canada, a major exporter to India, Turkey, and Gulf countries, is poised to meet export demands comfortably. Here's a snapshot of Agriculture Canada's forecasts:

- Dry Peas:

- 2023-24: 2.61 million tonnes (MT) production, 2.45 MT exports

- 2024-25 projection: 3.16 MT production, 2.40 MT exports

- Lentils:

- 2023-24: 1.80 MT production, 1.65 MT exports

- 2024-25 projection: 2.59 MT production, 2.10 MT exports

- Dry Beans:

- 2023-24: 339,000 tonnes production, 408,000 tonnes exports

- 2024-25 projection: 352,000 tonnes production, 355,000 tonnes exports

- Chickpeas:

- 2023-24: 159,000 tonnes production, 187,000 tonnes exports

- 2024-25 projection: 327,000 tonnes production, 190,000 tonnes exports

Interestingly, Canada has been aggressively selling lentils to India, aiming to secure market share before the Australian crop arrives.

Australian Pulse Update

Australia's pulse harvest is on the horizon, with chickpeas expected to be the star performer this season, driven by market demand and favorable weather. However, the overall picture is more complex:

- Logistical Challenges: Australian farmers face hurdles in transporting their crops to key markets like India, putting pressure on supply chains.

- Regional Variations:

- Western Australia: Initial dryness, followed by good winter rains, but a drier spring.

- South Australia: Consistently low rainfall and frost impacts.

- Victoria: Good subsoil moisture early on, but poor winter and spring rains, compounded by frost events.

- New South Wales and Queensland: Generally better conditions with full initial moisture and substantial rains.

- Lentil Setback: Australia's lentil crop has been particularly affected by adverse weather conditions, with the full impact yet to be assessed.

Market Outlook

The pulse market's behavior in the coming months will hinge on several factors:

- Indian Rabi Crop: The progress and outlook of India's rabi (winter) crop planting will be crucial, with current prospects looking favorable due to improved soil moisture and higher reservoir levels.

- Ramadan Demand: The approaching Ramadan season in Islamic countries will influence demand patterns.

- Supply Chain Efficiency: The ability of logistics networks to move Australian crops to international markets efficiently will be a key factor to watch.

Conclusion

As we navigate the complexities of the global pulse market, it's clear that both opportunities and challenges lie ahead. Canada's robust production forecasts suggest a strong export potential, particularly in lentils, while Australia's varied regional conditions highlight the impact of climate on crop outcomes. Key factors to watch include India's rabi crop progress, Ramadan-driven demand, and the efficiency of supply chains in moving Australian crops to international markets.