Summary

India's agricultural sector shows promise with increased kharif crop planting and well-filled reservoirs, but faces potential risks from uneven rainfall distribution and forecasted above-normal September monsoon. Meanwhile, the global cashew market is experiencing significant price increases due to production shortfalls and trade restrictions, with potential impacts on consumer demand and market dynamics.

India's Kharif Crop Situation

Positive Indicators

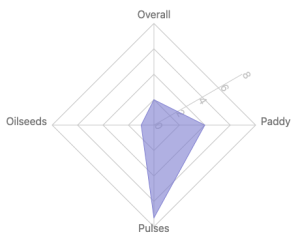

1. Kharif planting up by 2% as of September 5, 2024

- Paddy area increased by 4%

- Pulses area up by 7.3%

- Oilseeds coverage up by 1%

2. Major reservoirs at over 81% capacity

Cautionary Notes

1. India Meteorological Department predicts September monsoon at 109% of normal

2. Regional rainfall disparities persist, Northern India and Gangetic plains experiencing significant deficits

3. Risks of unseasonal or excess rain in some areas

Expert Opinions

1. CareEdge: Agriculture sector remains at risk due to regional rainfall disparities

2. Bank of Baroda's Aditi Gupta: Monsoon trajectory positive for inflation outlook, but risks remain

Potential Outcomes

1. Higher September rainfall could benefit rabi crops

2. Delayed La Nina emergence (until December) may prevent unseasonal rains

3. Good kharif crop could lead to:

- Lower pulses and edible oil imports

- Potential rice exports

Global Cashew Market Update

Price Trends

1. Raw cashew prices up over 50% in recent months

- Current range: $1,900 - $2,000 per tonne

- Cashew kernel prices around $4 per pound

Production Outlook

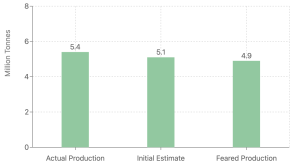

1. 2024-25 season estimate: 5.1 million tonnes (down from 5.4 million tonnes in 2023-24)

2. El Niño impact:

- Production may drop below 5 million tonnes

- Yield decrease in Cambodia, Vietnam, India, Benin, and Cote d'Ivoire

- ~100,000 hectares of cashew trees cleared since June 2023

Market Drivers

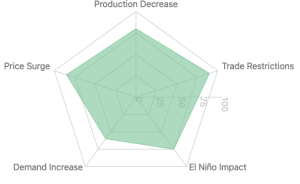

- Lower global production

-

Trade curbs by African nations: Cote d'Ivoire (25% of global production) banned raw cashew exports until December 2024

-

Global shortage of cashew kernels

-

Anticipated demand increase during Indian festival season

Market Outlook

1. Potential for further price increases

2. Risk of demand drop or shift to hand-to-mouth purchasing if prices surge too high