Key Takeaways:

- Australian grain prices are showing positive trends, potentially improving global supplies.

- Despite recent increases, prices remain significantly lower than last year.

- Forecasts predict higher crop yields across various grains and pulses in Australia.

- Australian exports could provide relief for some Asian countries.

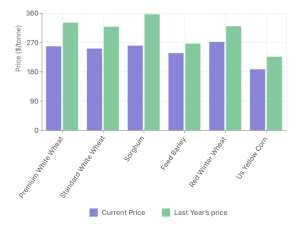

Price Trends:

Wheat

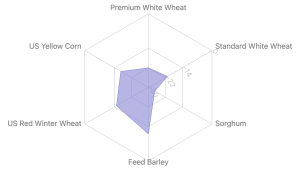

- Premium White Wheat: Up 1.5% to $258.43/tonne (22% lower than last year)

- Standard White Wheat: Up 1.5% to $251.61/tonne (21% lower than last year)

Other Grains

- Sorghum: $260.47/tonne (27% lower than last year)

- Feed Barley: Up to $237.49/tonne (11% lower than last year)

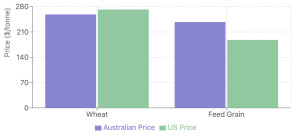

Global Comparison

- US No. 2 Red Hard Winter Wheat: Unchanged at $272/tonne (15% lower than last year)

- US No. 2 Yellow Corn: Up to $188/tonne (17% lower than last year)

Market Implications

- Improved Global Supplies: The increase in Australian grain prices, coupled with forecasts of higher crop yields, suggests a potential boost to global grain supplies.

- Price Stabilization: While prices have seen a recent uptick, they remain significantly lower than last year, indicating a more stable and potentially more affordable market for buyers.

- Diversification of Supply: For Asian countries, Australia's strong production could offer an alternative source of grains, potentially reducing dependence on other major exporters.

- Crop Variety: Forecasts predict higher yields not just in wheat, but also in corn, rice, lentils, chickpeas, and barley, offering a wide range of options for importers.

Outlook

The Australian grain market is showing promising signs for global supply chains. With prices remaining lower than last year despite recent increases, and forecasts predicting bumper crops, Australia is well-positioned to play a significant role in the global grains market this year. This could be particularly beneficial for Asian countries looking to secure their grain supplies.