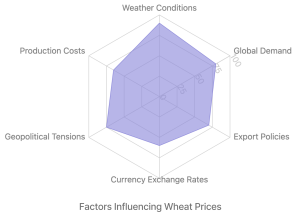

The global wheat market has experienced a sudden shift from bearish to bullish sentiment in recent days. This volatility is primarily driven by weather conditions in key exporting countries and geopolitical tensions.

Key Factors Influencing the Market

1. Weather Conditions

- Russia and Brazil experienced one of their driest Septembers on record

- Australian supply is expected to be lower

- These factors are likely to push up wheat flour prices

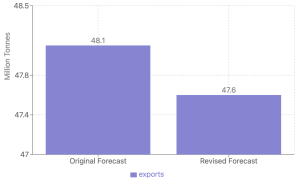

2. Russian Export Forecast

- Sovecon reduced its 2024-25 Russian wheat export forecast to 47.6 million tonnes (down from 48.1 million)

- Total grain exports from Russia now estimated at 55.4 million tonnes (previously 56.5 million)

- Russian wheat stocks are 14% lower year-on-year at 24.8 million tonnes

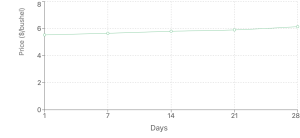

3. Price Trends

- Chicago Board of Trade wheat futures reached a three-month high at $6.14 a bushel

- 11% increase month-on-month, with 4% in the past week alone

4. Geopolitical Tensions

- Middle East crisis raising concerns about potential impacts on Russian exports

- Reports of a Russian attack on a Ukrainian river port contributing to the uptrend

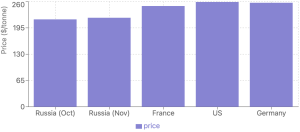

Current Export Prices (FOB)

- Russian wheat (12.5% protein):

- October delivery: $215-$217 per tonne

- November delivery: Above $217- $223 per tonne

- French wheat: $246-$252 per tonne

-

US wheat: $256-$262 per tonne

-

German wheat: $254-$260 per tonne

Market Sentiment

- Non-commercial market participants reduced their net short position in Euronext's milling wheat futures and options

- Commercial participants reduced their net long position

Mitigating Factor

The current dock workers' strike on the US eastern coast is unlikely to affect wheat exports significantly.

Outlook

The wheat market is likely to remain volatile in the short term, with weather conditions and geopolitical developments continuing to play crucial roles in price movements. Traders and buyers should closely monitor these factors for potential impacts on supply and pricing.