Summary

India's sesame market is showing positive momentum with rising export demand, despite prices being 20% lower year-over-year. The country has secured significant orders in recent Korean tenders, while production reaches an eight-year high. This market movement signals important opportunities for global traders and processors in the sesame value chain.

Market Dynamics and Price Trends

Indian sesame prices are experiencing an upward trajectory driven by strong export demand, although current levels remain significantly below last year's prices. At the Rajkot agri-terminal market, black sesame reached ₹180,000 per tonne on December 17, showing a slight weekly decline of ₹5,000. Similarly, white sesame was traded at ₹118,750 per tonne, down ₹4,500 from the previous week, but maintaining levels above November prices.

Production Outlook

The 2023-24 crop year is showing promising numbers for Indian sesame production:

- Kharif season production: 398,000 tonnes (up from 395,000 tonnes in 2023)

- Total projected production: 847,000 tonnes

- Highest production level since 2015-16 (850,000 tonnes)

This impressive output was achieved despite weather-related challenges in key growing regions:

- Gujarat faced damage from southwest monsoon rains

- Uttar Pradesh and Madhya Pradesh experienced crop impacts

- These setbacks were offset by overall strong production in other regions

Global Trade Developments

The recent Korea Agro-Fisheries and Food Trade Corporation tender has emerged as a significant market driver. The tender results showcase the competitive landscape of global sesame trade:

- India: Secured orders for 1,800 tonnes at approximately $1,745 per tonne

- Nigeria: Won contracts for 1,500 tonnes

- Burkina Faso: Obtained orders for 900 tonnes

- Tanzania: Secured deals for 600 tonnes

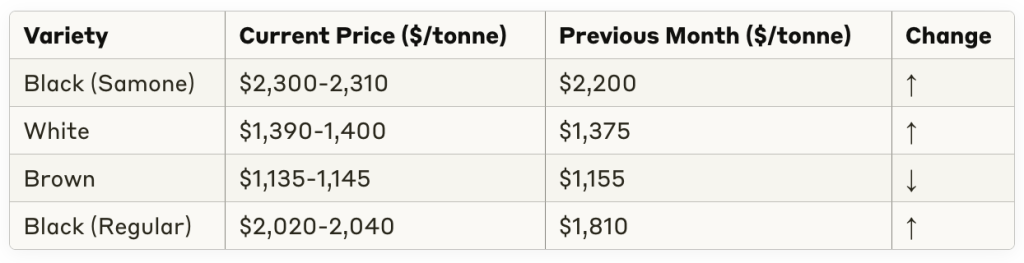

Myanmar Market Prices

Current Myanmar sesame prices reflect varying trends across different varieties:

Conclusion

The sesame market is demonstrating resilience and growth potential, with India's production reaching historic highs despite regional challenges. The successful participation in international tenders, particularly the Korean tender, indicates strong global demand. For traders and processors, these developments present opportunities for strategic positioning in the market. The varying price trends across different varieties and origins suggest the importance of maintaining a diversified sourcing strategy while monitoring market movements closely.

Keep following Hectar's market insights for more updates on global agricultural commodity trends and trading opportunities.