Summary

The global sesame market is experiencing an upward trend, with black sesame prices in Myanmar rising over 5% in recent weeks. This trend is driven by reduced cultivation area in India, weather-related concerns, and shifting global supply dynamics. The emergence of new production technologies and regions could reshape the market in the coming years.

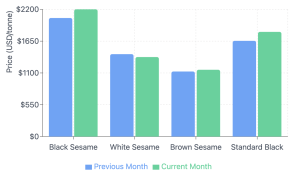

Price Movements Across Markets

In India's key trading centers, price variations are becoming more pronounced:

- Mumbai APMC: Black sesame holding steady at ₹17,000 per quintal

- Rajkot APMC: Prices have increased to ₹17,700 per quintal

- White sesame: Currently at ₹11,225 per quintal, down from ₹11,900 a month ago

Myanmar's export market is showing similar trends:

- Black sesame (Samone): $2,200/tonne (up from $2,050-2,060)

- White sesame: $1,375/tonne (down from $1,425)

- Brown sesame: $1,155/tonne (up from $1,125)

- Standard black sesame: $1,810/tonne (up from $1,655)

Supply-Side Factors

Several factors are contributing to the current market dynamics:

- Reduced cultivation area in India (1.14 million hectares, down from 1.22 million hectares)

- Potential crop damage concerns due to heavy rainfall in key growing regions

- Delayed harvest in India

- India's production stands at 0.81 million tonnes in 2023-24, marginally up from 0.80 million tonnes

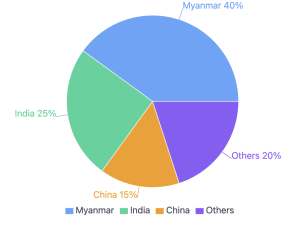

Myanmar's Dominant Position

Myanmar continues to be a crucial player in the global sesame trade:

- Annual production: approximately 8 million tonnes

- Major export destinations: China, Japan, Thailand, Singapore, and South Korea

- Recent Typhoon Yagi, while devastating, is not expected to significantly impact sesame production

- Favorable soil moisture conditions may actually benefit yield

Future Market Developments

Australia is emerging as a potential new player in the sesame market:

- Companies like AgriVentis and Equinom are conducting trials for locally-adapted varieties

- Equinom's development of machine-harvestable sesame could be a game-changer

- Export potential estimated at $200-300 million in the medium term

- Northwest Queensland identified as a promising cultivation region

Conclusion

The sesame market is experiencing a significant transformation, with traditional production centers showing price strength amid supply concerns. The introduction of new technologies, particularly in harvesting automation, coupled with the emergence of new production regions like Australia, could reshape the global sesame trade landscape. Traders and processors should closely monitor these developments, as they may present new opportunities for sourcing and market expansion in the coming years.