Summary:

Recent developments in global rice tenders, particularly from Indonesia and Bangladesh, coupled with India's record production estimates, suggest a potential bearish turn in rice prices for the 2024-25 season. This analysis explores how competitive bidding and production forecasts are reshaping the global rice trade landscape.

Competitive Bidding Intensifies

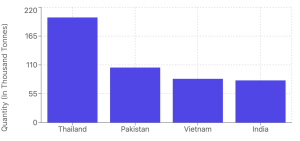

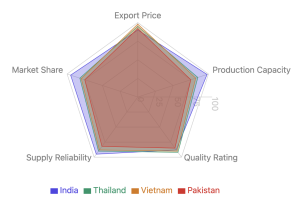

The first notable development comes from recent government tenders in Indonesia and Bangladesh, which have sparked intense competition among Asian rice-producing nations. Indonesia's Bulog's tender for 600,000 tonnes of 5% broken white rice saw remarkable participation:

- Pakistan secured four lots at $476/tonne (CNF), winning contracts for 105,000 tonnes

- Thailand dominated with seven lots ($512-523/tonne) for 200,500 tonnes

- Vietnam secured three lots for 83,500 tonnes

- India won three lots for 80,500 tonnes ($513-524/tonne)

Meanwhile, Bangladesh's parboiled rice tender showcased fierce competition among Indian exporters, with mere cents separating bids. The lowest bid came from Pattabhi Agro at $477/tonne (CIF) for 50,000 tonnes, with Bagadiya Brothers following closely at $477.77/tonne.

Price Trends and Market Response

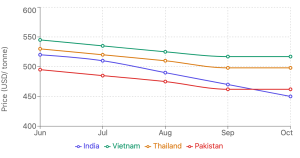

The global rice market has responded significantly to recent developments:

- Prices have declined over 10% since India eased export restrictions

- Current export quotes show interesting variations:

- India: $450/tonne

- Vietnam: $517/tonne (↓$17)

- Thailand: $498/tonne (↓$19)

- Pakistan: $462/tonne (↓$25)

- US: $744/tonne (↓$6)

- Uruguay: $765/tonne (↓$21)

Production Outlook

India's agricultural outlook adds another dimension to the market dynamics:

- Record kharif rice production estimated at 119.93 million tonnes

- Unprecedented paddy area coverage of 43.37 million hectares

- Digital surveys indicate a 6.5 million hectare increase in paddy acreage

The USDA's forecasts for 2024-25 are equally significant:

- Production estimate: 145 million tonnes (record)

- Expected area coverage: Over 50 million hectares

- Projected yield: 4.35 tonnes per hectare (4% above 5-year average)

Market Stabilizing Factors

Several factors could potentially moderate price declines:

- Lower production and acreage in Bangladesh and the Philippines

- Increased import projections for Iraq and Saudi Arabia

- Expected reduction in exports from Myanmar and China

- Rising consumption forecasts for countries like Guinea and India

Conclusion

The global rice trade is entering a potentially transformative phase, with competitive pricing and record production estimates suggesting a bearish outlook. However, regional variations in production and changing import-export dynamics could provide some price support. Traders and stakeholders should closely monitor these evolving patterns, particularly the interplay between aggressive pricing strategies and shifting supply-demand dynamics in key markets.

This complex market environment underscores the importance of data-driven decision-making and strategic positioning for both exporters and importers in the global rice trade.