Summary:

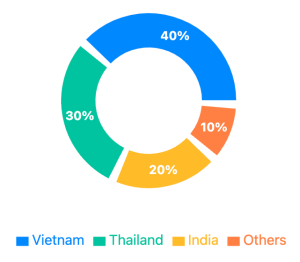

The global rice market is experiencing significant shifts with two major developments: Indonesia's inclusion of India in its substantial rice tender and the Philippines' potential increased import activity. These developments could have notable implications for global rice prices and trade patterns.

India's Diplomatic Win in Indonesian Rice Tender

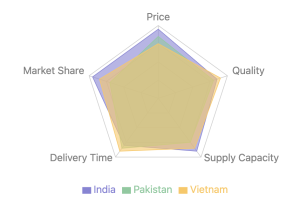

In a notable diplomatic victory, India has secured a place in Indonesia's latest rice import tender for 340,000 tonnes. This development marks a significant shift from Jakarta's initial stance, which had limited participation to Pakistan, Cambodia, Thailand, and Vietnam. India's inclusion through Indonesia's trade wing Bulog signals growing confidence in Indian rice exports.

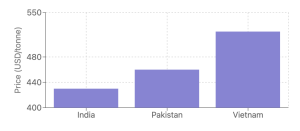

The current price dynamics strongly favor Indian exporters:

- India: $427- $433/tonne (5% broken white rice)

- Pakistan: $457 - $463/tonne

- Vietnam: $517- $523/tonne

[INSERT LINE CHART: "Rice Price Trend (June - October 2023)" HERE]

This competitive pricing, combined with India's removal of export restrictions and expectations of a record harvest, positions the country strongly in the tender competition. The resulting price war could benefit importing nations as suppliers may need to reduce their offers to remain competitive.

The Philippine Factor: A Potential Market Disruptor

The Philippines is emerging as a crucial player in the market dynamics, driven by several factors:

- Policy Change Impact:

- Current concessional import duty: 15%

- Standard import duty: 35%

- Imminent deadline driving urgent purchases

- Weather-Induced Pressure:

- Crop damage from El Niña (previous year)

- Further impact from La Niña (current year)

- Already imported 3.57 million tonnes by mid-October

Market Outlook: Competing Forces at Play

The market is facing two opposing forces:

- Downward Pressure:

- New crop arrivals across major growing regions

- Expected 15-20% price decline in coming months

- Competitive tension in Indonesian tender

- Price Support Factors:

- Philippine's accelerated buying

- Strategic stock building by importers

- Supply chain adjustments

Looking Ahead

The Bulog tender's outcome, due October 31, will likely set the tone for near-term price trends. While the overall market trajectory points toward lower prices, the Philippines' urgent import needs could moderate the decline.