Summary

Recent policy changes in India, including the easing of export restrictions on rice, have significantly impacted the global rice market. This has led to price adjustments across major exporting countries and increased competitiveness. However, geopolitical tensions and potential crop damage in key producing regions could introduce volatility in the coming months. This analysis examines current market dynamics, price comparisons, and crucial factors that may influence future trends in the global rice trade.

Recent Policy Changes in India

- White rice exports allowed with a Minimum Export Price (MEP) of $490/tonne

- Export duty on parboiled, brown, and husked rice reduced from 20% to 10%

Impact on Global Rice Prices

- Thailand cut export prices by 10%

- Vietnam prices expected to decline

- Asian rice prices fell between $10 and $72 per tonne after India eased export curbs

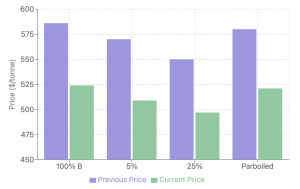

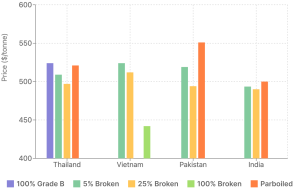

Current Price Comparison (FOB, $/tonne)

Thailand

- 100% grade B white rice: $522-$526(down from $586)

- 5% white rice: $507-$511 (down from $570)

- 25% white rice: $495-$499 (down from $550)

- Parboiled: $519-$523

Vietnam

- 5% broken: $522-$526

- 25% broken: $512-$516

- 100% broken: $440-$444

Pakistan

- Parboiled: $549-553

- 5% white rice: $517-521

- 25% broken: $492-496

India

- 5% broken: $491-496

- 25% broken: $488-492

- Parboiled: $498-502 (including 10% export duty)

Market Dynamics

- Indian exporters seeing increased inquiries from old buyers

- India's price competitiveness: $25-30/tonne (down from $100/tonne two years ago)

- Basmati prices dropped to around $1,000/tonne, MEP of $950/tonne removed

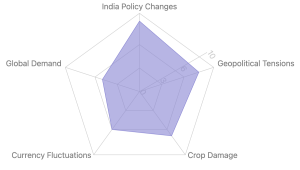

Key Factors to Watch

1. Geopolitical tensions in the Middle East

- Potential for wild currency fluctuations in Thailand, Vietnam, and Pakistan

- Indian rupee expected to remain steady

2. Crop damage in major producing countries

- Potential 5 million tonne production drop in Thailand, Vietnam, and Myanmar

- Damage assessment pending in Indian states like Bihar, Bengal, Chhattisgarh, Telangana, and Andhra Pradesh

Outlook

- Global rice production trends to become clearer by end of the month

- Market volatility expected due to only one-tenth of global production being exported

- India's competitive edge may shrink if competing countries' currencies depreciate sharply

Conclusion

The global rice market is currently characterized by increased competition and lower prices following India's policy changes. However, geopolitical tensions and potential crop damage introduce significant uncertainties. With only a fraction of global rice production traded internationally, these factors could lead to heightened market volatility. Stakeholders should remain vigilant, closely monitoring production assessments, currency fluctuations, and trade policies in the coming weeks, as these will be crucial in shaping the market's direction.