Executive Summary

The global chickpea market is currently experiencing significant shifts in supply and demand dynamics, with recent price fluctuations reflecting the complex interplay of international trade, weather conditions, and strategic decisions by key producing countries. This report provides an in-depth analysis of current market trends, key players, the factors influencing the price trends and future outlook for the chickpea trade.

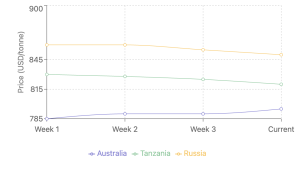

Recent Price Trends

Chickpea prices have seen a slight downturn in recent weeks, dropping from $900 to below $850 per tonne. However, the future trajectory of prices remains uncertain, largely dependent on the actions of major producing countries such as Australia, Russia, and Tanzania.

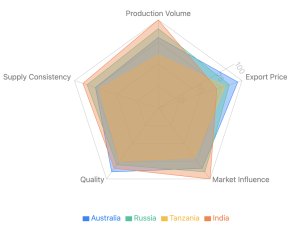

Key Players and Their Strategies

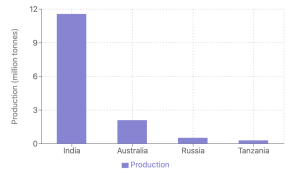

While India faces a 6.5% decrease in chickpea production this year, it remains a dominant force in the global market.

1. Australia

Australian farmers are adopting a bullish stance in response to frost damage affecting their pulse crops. Recent price adjustments include:

- India: Increased by $5 per tonne

- Bangladesh: Increased by $10 per tonne

- Middle East: Increased by $20 per tonne

For November-December shipments, Australia is now quoting $790 per tonne, up from $785 last week. Shipments to the UAE for October-November have risen to $830 from $810.

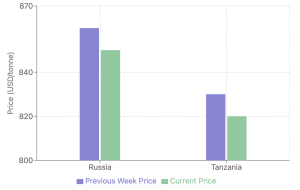

2. Russia

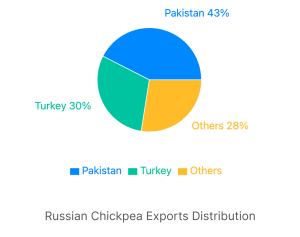

Russia has emerged as a significant player in the chickpea market:

- 2023 production: 528,000 tonnes (68% increase from 2022)

- Farmer incentives: Chickpea prices 60-80% higher than usual crops

- Key buyers:

- Pakistan (40-45% of Russian produce)

- Turkey (for re-export to Jordan, UAE, and Iraq)

Russia's growing influence is further amplified by India's recent decision to allow Russian pulse imports, including chickpeas.

3. Tanzania

Tanzania, along with Russia, has adopted a strategy of reducing prices by $10 per tonne. They are currently offering chickpeas to India at $820 per tonne for October-November shipments, down from $830.

Indian Market Overview

India, a significant player in the chickpea market, has experienced a 6.5% decrease in production this year, with output at 11.57 million tonnes. The upcoming rabi sowing season (October-November) will be crucial in determining future supply and global market dynamics.

Market Drivers to Watch

- Weather conditions: Recent events have highlighted the significant impact of climate on crop yields and market prices.

- India's rabi planting: The extent of chickpea planting in India will greatly influence the global supply and demand balance.

- Russian export strategies: As a rising player in the market, Russia's export decisions will be increasingly influential.

- Australian crop recovery: The extent of frost damage and farmers' pricing strategies will affect global supply and price trends.

Conclusion and Future Outlook

The chickpea market remains in a delicate balance, with multiple factors influencing price trends and trade flows. As global demand for plant-based proteins continues to grow, the importance of chickpeas in international trade is likely to increase.