Summary

Global black matpe (urad) prices are experiencing a significant surge due to poor crop quality in India and low stock levels in Myanmar. This article explores the factors driving this price increase, including weather-related crop damage in India, reduced cultivation area, and supply constraints in Myanmar. We'll examine the current market situation, price trends, and potential future developments that traders and investors should watch.

Market Overview

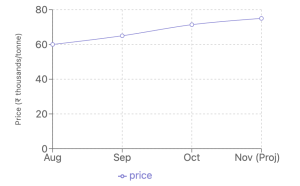

The global black matpe market is witnessing a notable price surge, with increases ranging from $10 to $40 per tonne depending on the destination. This upward trend is primarily attributed to two key factors:

- Poor crop quality in India due to recent weather conditions

- Low stock levels in Myanmar, a major exporter

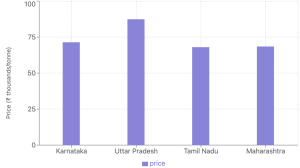

In India, the world's largest consumer of black matpe, domestic prices have started to climb. Recent data from Agmarknet shows varying prices across different states:

- Karnataka: ₹71,240 - ₹71,540 per tonne

- Uttar Pradesh: ₹87,230 - ₹87,530 per tonne

- Tamil Nadu: ₹67,850 - ₹68,150 per tonne

- Maharashtra: ₹68,320 - ₹68,620 per tonne

These prices represent a significant increase from the ₹45,000-70,000 ($536-833) range observed at the beginning of the month. However, it's worth noting that current prices are still lower than those seen during the same period last year, primarily due to quality issues caused by recent rains.

Global Export Market Trends

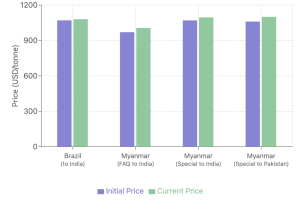

The price surge is not limited to the Indian domestic market. In the export market, we're seeing notable increases:

- Brazil: Increased offers by $10 to $1,080 per tonne for October-November delivery to India

- Myanmar:

- Fair Average Quality (FAQ) black matpe: Increased by $35 to $1,005 per tonne for October-November delivery to India

- Special quality black matpe: Increased by $25 to $1,095 per tonne for India, and by $40 to $1,100 per tonne for Pakistan

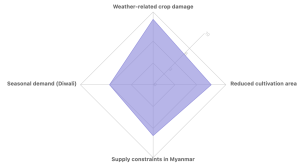

Factors Driving the Price Surge

Several factors are contributing to the current price dynamics:

- Weather-related crop damage: September rains have affected black matpe crops in Maharashtra, Gujarat, Uttar Pradesh, and Karnataka. An estimated 30% of the crop may have been impacted.

- Reduced cultivation area: The area under kharif black matpe cultivation has dropped to 3.07 million hectares from 3.26 million hectares last year. Madhya Pradesh, a key growing region, has seen a significant reduction from 1.39 million hectares to 0.98 million hectares.

- Supply constraints in Myanmar: Myanmar's small black matpe crop, typically available in December, will not arrive this year. The new crop is expected only in February, with current stocks estimated at just 200,000 tonnes.

- Seasonal demand: The approaching Diwali festival in India typically sees increased demand for black matpe, which could further support prices in the short term.

Future Outlook

While the market may see some additional gains ahead of Diwali, this could be short-lived as demand generally weakens after the festival. However, several factors could influence prices beyond December:

- Weather forecasts: The India Meteorological Department has predicted above-normal rainfall for October-December, which could impact both crop quality and harvesting.

- Myanmar's supply situation: With low current stocks and delayed new crop arrivals, supply tightness could persist into early 2024.

- Bay of Bengal weather patterns: Any significant weather events in this region could affect Myanmar's production and exports.

Conclusion

The black matpe market is currently experiencing a complex interplay of factors driving prices higher. Poor crop quality in India, reduced cultivation area, and supply constraints in Myanmar are creating a bullish sentiment in the short term. However, traders and investors should remain vigilant of potential shifts in demand patterns post-Diwali and keep a close eye on weather developments in both India and Myanmar.

As we move into 2024, the market will likely be shaped by the success of Myanmar's upcoming crop and any potential changes in India's import policies. Stakeholders in the black matpe trade should stay informed about these developments and be prepared to adapt their strategies accordingly.