Summary

India's substantial carryover stock of red lentils is set to reshape the global market in the 2024-25 season. With reduced import needs from India, increased production in Canada, and emerging competition from Russia and Kazakhstan, the red lentil market is trending bearish. This article explores the key factors influencing this shift such as India's huge carryover stock, increased production in Canada etc. and its implications for traders and investors in the agri-commodity space.

India's Huge Carryover Stock

The National Agricultural and Cooperative Marketing Federation of India (Nafed) is sitting on a substantial carryover stock of 800,000 tonnes of red lentils. This stockpile is expected to have a bearish impact on the market in the coming season. Here's why:

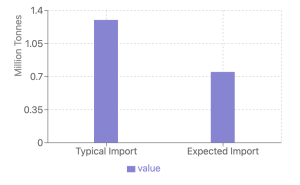

- Reduced Import Needs: India, typically importing 1.2-1.4 million tonnes of red lentils annually, may see its import requirements drop to around 750,000 tonnes.

- Market Flooding: Nafed is anticipated to release about 75% of its stock into the open market, potentially driving prices down.

Global Supply Dynamics

While India's situation is pivotal, it's essential to look at the global picture:

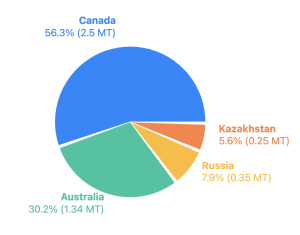

- Canada: Expecting a bumper crop with a 15% increase in acreage, potentially producing an additional 800,000 tonnes.

- Australia: Forecasts suggest a lower production of 1.34 million tonnes (some estimates as low as 1 million tonnes).

- Russia and Kazakhstan: Emerging as competitive suppliers with estimated productions of 350,000 and 250,000 tonnes respectively.

Price Competitiveness

Russian red lentils are currently the most competitive, priced $40-$50 lower than Australian and Canadian offerings. This price advantage could reshape traditional trade flows and supplier relationships.

Market Outlook and Implications

- Bearish Trend: Despite challenges in the Australian crop, the overall market outlook leans bearish.

- India's Pivotal Role: The depth of price declines will largely depend on India's actions regarding its Nafed stocks and the upcoming rabi season planting.

- Shifting Supply Chains: Traders should watch for potential shifts in supply chains as Russia and Kazakhstan increase their market presence.

- Import Policies: Keep an eye on India's import policies. While currently allowing duty-free imports until March, future policy changes could significantly impact global trade flows.

What to Watch

- India's rabi season planting (November-December)

- Nafed's stock release strategy

- Developments in Canadian and Australian harvests

- Price movements in Russian and Kazakh Red Lentils

Conclusion

The red lentil market is entering a phase of significant change, driven by India's large carryover stocks and shifting global supply dynamics. For traders and investors, this presents both challenges and opportunities. The key to success will be staying ahead of market trends by closely monitoring policy changes in major importing countries like India, and being prepared to adapt to new supply chain realities.