Executive Summary

Recent speculation about India lifting its ban on rice exports has been prevalent in industry circles and media reports. However, a critical analysis of key factors suggests that the ban is likely to persist, at least until November, with some industry insiders projecting its continuation through the end of the year. This analysis examines the multifaceted reasons behind this projection and explores the potential implications for global rice markets.

Key Factors influencing Policy Persistence:

1.Domestic Food Security Imperatives

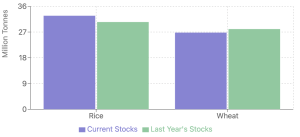

- Buffer Stock Levels: As of August, the Food Corporation of India reported rice buffer stocks at 32.7 million tonnes, a record high.

- Wheat Stock Deficit: Conversely, wheat stocks stand at 26.8 million tonnes, lower than the previous year's 28.04 million tonnes.

- Policy Implications: The government's substitution of rice for wheat in welfare schemes necessitates maintaining ample rice stocks to meet domestic requirements.

2. Ethanol Production Allocation

- Recent Directive: The Indian government has allocated 2.35 million tonnes of rice for ethanol production during September and October.

- Market Impact: This allocation is expected to exert additional pressure on rice demand within the domestic market.

3. Production Uncertainty

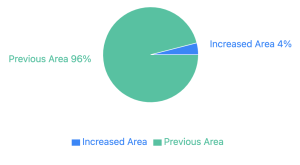

- Acreage Increase: As of August 30, the area under kharif paddy cultivation showed a 4% increase to 408.72 lakh hectares.

- Regional Variability: Key rice-growing states face divergent weather impacts:

- Punjab and Haryana: Insufficient rainfall 2. Telangana and Andhra Pradesh: Experiencing record precipitation

- Policy Considerations: The government is likely to adopt a "wait and watch" approach, pending the release of the first advance estimate of kharif crops by month-end.

4. Procurement Program Dynamics

- Commencement: The rice procurement program is scheduled to begin on October 1.

- Policy Influence: The pace and volume of procurement will be critical factors in determining the government's next policy steps.

Global Market Adaptation

The global rice market has shown signs of adaptation since India's export ban in July 2023:

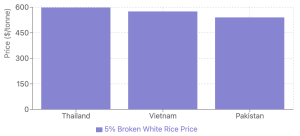

- Alternative Suppliers: Pakistan, Myanmar, Thailand, and Vietnam have stepped in to fill the supply gap.

- Price Trends: Asian rice demand has slackened, with prices declining to a three-month low.